Series B:

Uptiq raises $25M to add AI agents to bank workflows

Read More

-

Small and medium-sized enterprises (SMEs) and micro businesses are often described as the backbone of economies , yet many struggle to access credit. Traditional lending models rely heavily on credit bureau history, formal financial statements, and collateral. For many small businesses , especially early-stage, informal, or those with thin credit histories , these criteria act as barriers.

As a result:

But what if lenders could more fairly and accurately assess a small business’s creditworthiness , without depending solely on traditional credit bureau scores or collateral?

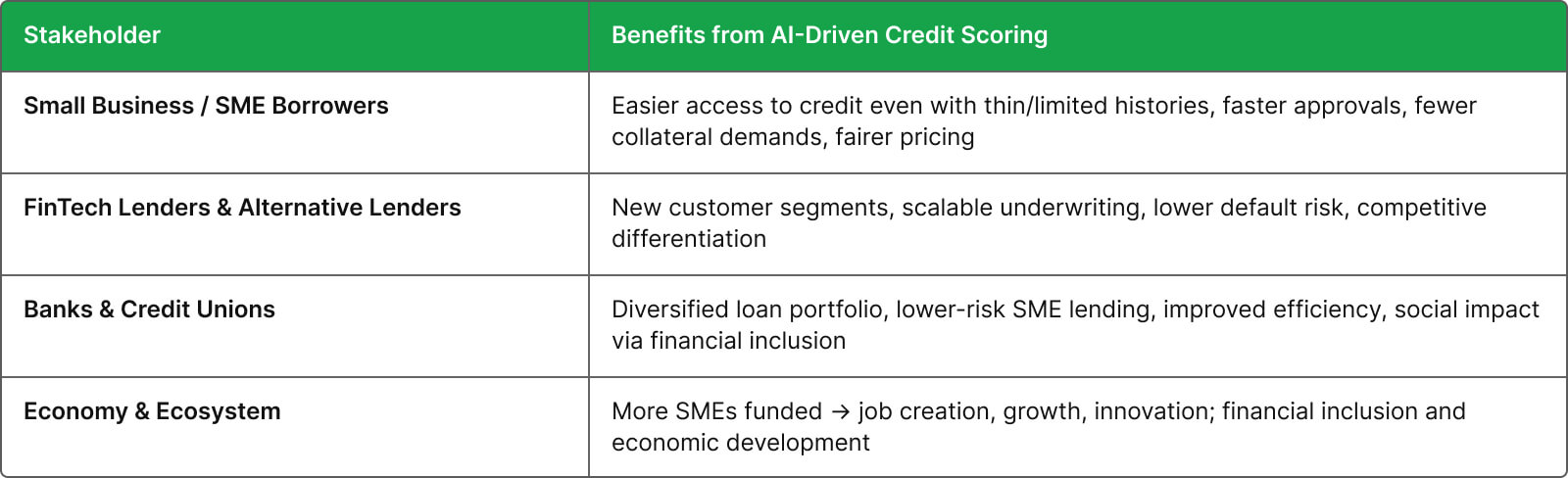

That’s where AI-driven credit scoring comes in. By leveraging advanced data analytics, machine learning models, and alternative data sources, lenders can better understand a business’s real-time financial health , and extend credit to deserving but underserved small businesses.

At Uptiq, we believe AI-driven credit scoring has the power to unlock credit access for SMEs, drive inclusion, reduce risk, and open new lending opportunities , all at scale.

Traditional credit scoring for businesses often involves static models: credit bureau ratings, financial statements, collateral valuations, and fixed underwriting rules. AI-driven credit scoring , sometimes called “alternative data credit scoring” , enhances and often replaces these with a dynamic, data-rich, real-time approach:

The result: a more nuanced, inclusive, and accurate method to evaluate small business creditworthiness , especially for those previously deemed “unscorable” under traditional models.

AI models that leverage alternative data can identify creditworthy businesses without long credit histories or heavy collateral , opening access to entrepreneurs, early-stage firms, and informal businesses. Research shows AI-scoring significantly improves the ability to underwrite SMEs that traditional models reject.

This helps:

AI-driven scoring automates data collection, credit analysis, and risk evaluation , reducing underwriting turnaround from days or weeks to minutes or hours.

This benefits both lenders (lower operational cost, higher throughput) and borrowers (faster decisions, reduced friction).

Empirical studies show AI/ML credit-scoring models outperform traditional statistical or rule-based scoring. For instance, research using random-forest (a machine-learning algorithm) improved accuracy, precision, recall, and F1-scores significantly compared to traditional models.

This translates to lower default risk, better pricing, optimized loan portfolios, and improved lender returns over time.

Because AI-based systems can constantly incorporate new data , transaction flows, sales growth/decline, payment behavior , lenders can monitor risk in real time, adjust credit limits or terms, or even pre-empt trouble , rather than waiting for scheduled reviews. This agility is especially important for SMEs whose fortunes can change rapidly.

AI-driven credit scoring can reduce bias inherent in traditional models (which often favor businesses with long credit histories or substantial collateral). By focusing on actual business behavior and real-time data, lenders can offer fairer credit decisions. This supports financial inclusion and democratizes credit access.

AI-driven credit scoring is powerful , but there are risks and considerations that institutions must manage:

Despite these challenges, with proper governance, transparency, and hybrid human-plus-AI review, AI-driven credit scoring holds great promise.

At Uptiq, our Client Lending Platform is built with AI-driven credit scoring at its core , designed to help institutions unlock credit for underserved small businesses while managing risk effectively. Here’s how:

Uptiq’s platform can ingest data from multiple sources , bank statements, accounting software, GST/tax filings, receivables/payables, cash-flow data, invoices, digital payment records, and more. This creates a comprehensive, real-time view of a business’s financial health.

This multi-dimensional data intake is key to building accurate AI credit models tailored for SMEs, not just large firms with full financial histories.

Using ensemble ML methods (e.g. random forests, gradient boosting), Uptiq generates risk scores that reflect actual business behavior and repayment potential , not just historical credit bureau data.

This enables lenders to:

With AI scoring, loan applications can be processed in minutes: data extraction, analysis, risk assessment, decisioning , all automated. This dramatically reduces turnaround time and operational costs.

Faster approvals reduce friction for SMEs, making credit accessible when they need it.

Uptiq doesn’t stop at origination. The platform continues to monitor business performance, cash flow, payment behavior, and other signals , enabling early warning for potential defaults, dynamic repricing, or proactive interventions.

This ongoing monitoring helps lenders protect their portfolio while giving borrowers flexibility and transparency.

Understanding that fairness, transparency, and regulatory compliance are critical , Uptiq’s AI models come with explainable outputs and audit trails. Lenders can review why a decision was made, modify thresholds, override when needed, and ensure compliance.

This hybrid approach , AI powered, human guided , balances innovation with prudence.

By bridging the SME credit gap, AI-driven credit scoring helps fuel entrepreneurship, business growth, and economic resilience , while also creating sustainable lending portfolios for financial institutions.

As AI models grow more sophisticated, and as open banking / open finance frameworks expand access to real-time financial data, the possibilities for SME credit scoring will expand further.

We expect:

With platforms like Uptiq, this future is not distant , it’s already here.

The traditional barriers for SMEs , thin credit, limited collateral, manual underwriting , have long restricted access to much-needed working capital. But AI-driven credit scoring is changing that.

By combining alternative data, machine-learning models, and real-time analytics, lenders can offer fair, fast, and inclusive financing to small businesses , unlocking growth, supporting entrepreneurship, and building resilient portfolios.

For institutions looking to serve SMEs in a scalable and responsible way, Uptiq’s Client Lending Platform offers the tools, infrastructure, and intelligence to make it happen.

Ready to unlock credit for underserved SMEs and grow your lending portfolio? Book a Demo with Uptiq today.

RELATED